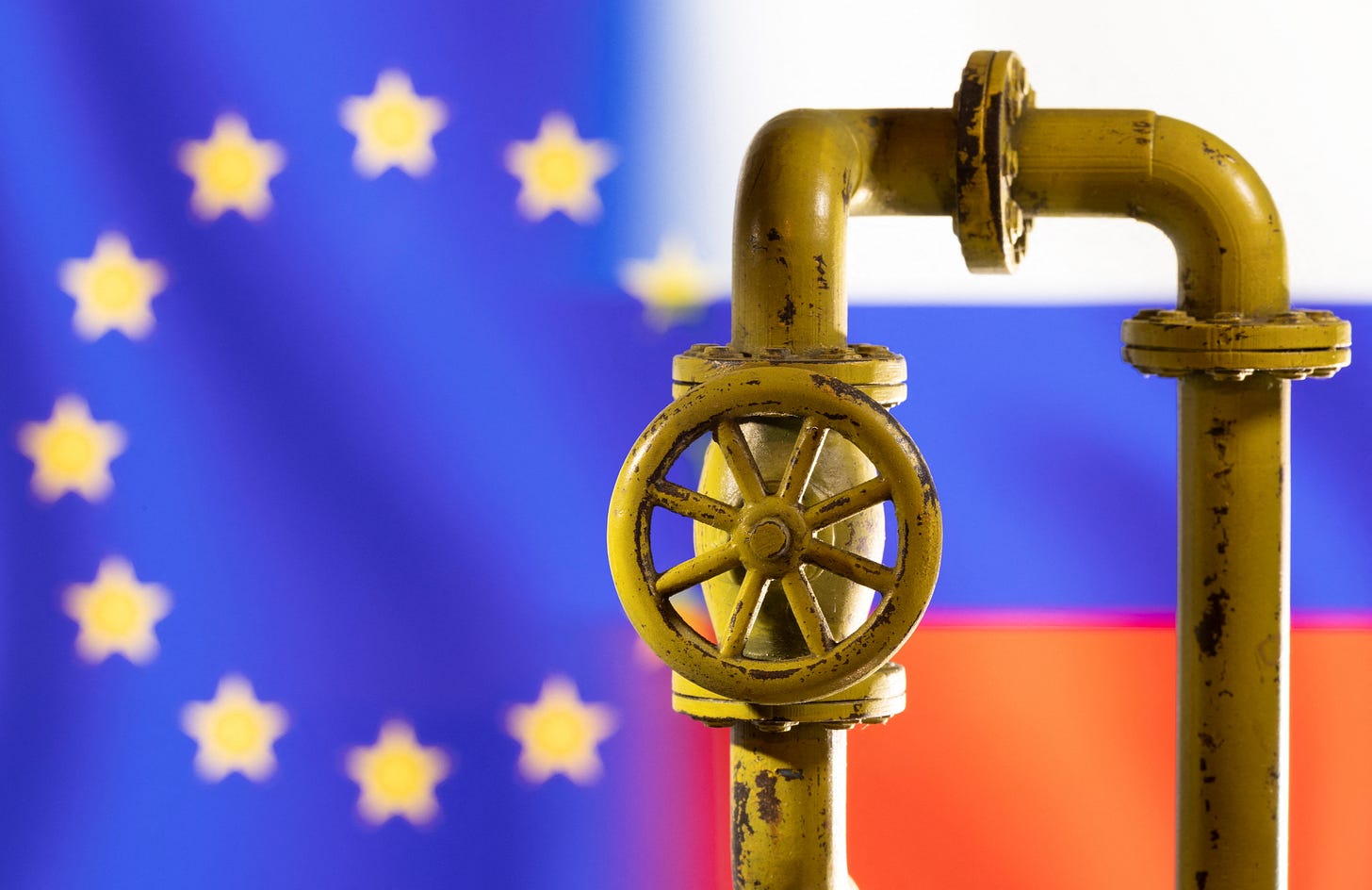

EU Shelves Plan to Slash Russian Oil Price Cap Amid Middle East Turmoil

Fears of a global energy shock from the Israel-Iran conflict prompt Brussels to hit pause on a $45-per-barrel proposal that could have cost the Kremlin billions in wartime oil revenue.

The European Union will not forge ahead with plans to impose a tough new price cap on the Russian oil exports funding the Kremlin's war in Ukraine in light of concerns that a new conflict in the Middle East will drive up oil prices. The proposal, which would have seen the maximum price of Moscow's oil slashed from $60 per barrel to $45, was due to be discussed Monday in Brussels by foreign ministers from across the bloc. However, two diplomats confirmed to POLITICO that the burgeoning conflict between Israel and Iran meant that the plan is no longer workable. "The idea of lowering the price cap is probably not going to fly because of the international situation in the Middle East and the volatility," said one diplomat, granted anonymity to speak frankly about the market-sensitive policy. "At the G7 meeting this week, it was agreed by all the countries they would prefer not to take the decision right now," the diplomat added. "The prices were quite close to the cap; but now the prices are going up and down, the situation is too volatile for the moment." At the G7 summit in Canada, European Commission President Ursula von der Leyen admitted the existing measures "had little effect — but in the last days, we have seen that the oil price has risen [and] the cap in place does serve its function ... So for the moment, there's little pressure on lowering the oil price cap." The pitch for a $45-per-barrel cap would translate into billions of dollars in lost oil revenues for Russia as it scrambles to maintain high levels of military spending and plug holes in its national budget. After being initially proposed by Ukraine, the lowered price cap was included in the text of the EU's 18th sanctions package, unveiled earlier this month. However, without support from United States President Donald Trump, implementing the idea would prove impossible, experts point out. "Lowering the cap without a buy-in from the U.S. wouldn't be effective," said Maria Shagina, a sanctions expert at the International Institute for Strategic Studies. "Designed as a buyer's cartel, the cap needs the U.S. to be part of it." - Politico

My hot take: Leaders in Brussels are likely breathing a quiet sigh of relief that they no longer need to push through a contentious Ukrainian-backed proposal to further cap Russian oil exports. Even if the measure had passed, its impact would have been negligible—around 90% of Russian crude is already being shipped above the current price cap. Instead, the EU is focusing on its 18th sanctions package—yes, eighteenth—described by Commission President Ursula von der Leyen as “hard-biting.” This round targets the energy and banking sectors, expands export bans, and tightens anti-circumvention measures. But the sheer number of packages begs the question: what if Brussels had deployed its full sanctions arsenal back in February 2022, when Russia first launched its full-scale invasion of Ukraine? Would the war have reached this grim stage—with Ukrainian cities battered nightly by missiles and drones, and Russian forces advancing on the front line? The mood surrounding Ukraine’s war effort is shifting—and not in Kyiv’s favor. At the G7 summit in Canada, host country Canada reportedly dropped language on Ukraine from the final statement after pushback from the United States. Even with President Zelensky in attendance—providing yet another photo op alongside the majestic Rocky Mountains—there were few tangible gains for Ukraine. Closer to home, the European Central Bank is blocking the use of immobilized Russian central bank assets to help Ukraine win the war. ECB President Christine Lagarde cited the need to preserve Europe’s “geopolitical credibility.” But as I told Times Radio yesterday: What credibility will Europe have left if Russia, sensing a lack of resolve, decides to gobble up more of eastern Europe?

The head of Russia’s nuclear energy corporation says that Russian specialists are continuing to work at Iran Bushehr nuclear power plant, and that the situation there remains normal. Alexei Likhachev said that he hoped that Moscow’s warnings to Israel not to attack the site had been received by the Israeli leadership. Russian leader Vladimir Putin said on Thursday that more than 200 Russians were continuing to work at Iran’s Russian-built Bushehr nuclear power plant, and that an agreement had been reached with Israel over their safety. Russia, which has a strategic cooperation agreement with Iran, has strongly urged the US not to join in Israel’s strikes on Israel, warning it would destabilise the region and risked triggering a nuclear catastrophe - Al Jazeera

Russia is not coming to Iran’s defence, despite the regime’s drone supplies to the Kremlin. It can also be safely assumed both Israel and Iran have carefully studied drone warfare in the Ukraine/Russia war, I told Times Radio of London. Watch the extended discussion here where we also discuss Russia’s growing footprint in Georgia.

Russian President Vladimir Putin met his Indonesian counterpart Prabowo Subianto as Moscow bids to strengthen ties in the Global South amid Western efforts to isolate the country following its war on Ukraine. On Thursday, Putin and Prabowo met in the Russian city of St Petersburg and signed a declaration on strategic partnership. Danatara, Indonesia’s sovereign wealth fund, and the Russian Direct Investment Fund, whose CEOs were also in Saint Petersburg, signed an agreement to create an investment fund worth 2 billion euros ($2.29bn). In a statement after the talks, Prabowo said that the relationship between the two countries was “getting stronger again”. “My meeting with President Putin today was intense, warm and productive. In all fields of economics, technical cooperation, trade, investment, agriculture – they all have experienced significant improvements,” he said. Moreover, during the meeting at the Konstantin Palace, Putin acknowledged Indonesia’s entry into the BRICS (Brazil, Russia, India, China, South Africa) grouping of emerging economies as a full member - AJE

The BBC has threatened legal action against Perplexity, accusing the AI startup of training its "default AI model" using BBC content, the Financial Times reported on Friday, making the British broadcaster the latest news organisation to accuse the AI firm of content scraping. The BBC may seek an injunction unless Perplexity stops scraping its content, deletes existing copies used to train its AI systems, and submits "a proposal for financial compensation" for the alleged misuse of its intellectual property, FT said, citing a letter sent to Perplexity CEO Aravind Srinivas. Perplexity has faced accusations from media organizations, including Forbes and Wired, for plagiarizing their content but has since launched a revenue-sharing program to address publisher concerns. Last October, the New York Times sent it a "cease and desist" notice, demanding the firm stop using the newspaper's content for generative AI purposes. Since the introduction of ChatGPT, publishers have raised alarms about chatbots that comb the internet to find information and create paragraph summaries for users. The BBC said that parts of its content had been reproduced verbatim by Perplexity and that links to the BBC website have appeared in search results, according to the FT report - Reuters

Chinese state-owned airlines have joined an intensifying price war, although unwillingly, amid challenges including local passengers’ weakening spending power and rising market competition. Air China, Southern Airlines and Eastern Airlines have been facing huge losses for five years since the Covid-19 pandemic broke out in early 2020. Many Chinese airlines now offer domestic round-trip tickets at about 200 to 300 yuan (US$28 to US$42), as it is a low season before the summer holidays. Round-trip tickets to remote cities are 80- 90% off, while those to key cities like Beijing are 40-50% off. Budget airlines such as Spring Airlines and Juneyao Air are growing fast in this price war. Currently, the central government does not intend to stop the price war or reduce competition in the airline industry. “The decline in air ticket prices is good news for the tourism market as it can effectively boost the number of tourists and create growth for related industries such as hotels, catering, transportation and retail,” a Yunnan-based writer says in an article. She thinks the trend will also help diversify the tourism market, as new and small tourism sites can emerge - Asia Times